Myanmar Banking Sector 2025 : A Way Forward by Roland Berger

To have a quick look at the banking and finance industry here in Myanmar, there are 13 branches of foreign banks, 15 finance companies, 24 private banks, 4 state-owned banks, 45 representative offices of foreign banks and finance company. And mobile banking aka mobile financial service industry is also booming. after Central Bank of Myanmar issued the Regulation on Mobile Financial Services on March 30, 2016. Within last month Central Bank of Myanmar granted Foreign Bank Branch License to E.SUN Commercial Bank Limited and State Bank of India.

(ref : CBM Website)

To coup with economic changes Myanmar’s banking sector is set for further liberalization and reform. With the help of technology and mobile penetration everyone in the industry are expecting to reduce unbanked population in the country. This is the time to look forward where the industry is heading with the help of experts and fortunately there is a study released by Roland Berger during September about banking industry here in Myanmar.

Following is the study as it is …

Myanmar banking industry 2025: Extensive reforms and transformations will enable banking sector to grow eightfold

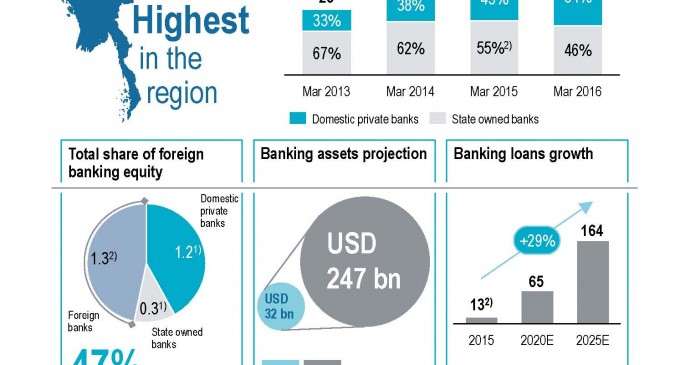

Yangon, September 2016: The nascent banking industry in Myanmar is expected to undergo intense transformations, where the sector is likely to create 120,000 more jobs by 2025. According to a new study by Roland Berger entitled:Myanmar Banking Sector 2025: The Way Forward, the sector’s asset base is bound to expand eightfold from its current size in almost a decade, to USD 247 billion at 23% CAGR from 2015. By 2025, loans will have increased more than tenfold to USD 164 billion at 29% CAGR.

“While the outlook is very promising, there are clear short- and mid-term gaps that both banks and the regulators must strive to close, such as financial inclusion. 77% of the population is not in the banking system, which is the highest in the region,” said Philippe Chassat, Partner, Co-Head Asia Pacific Financial Services and coauthor of the study. “To achieve the banking sector’s fullest potential, necessary reforms need to take place through a concerted effort by all stakeholders or sector growth will stall and the entire economic engine may stutter,” he warned.

Structural reforms required to unleash sector and economic growth

Despite initial reforms and opening, the banking sector in Myanmar remains far from being able to fulfill its core function and support the economic growth of the country. A series of multiyear reforms need to be rapidly initiated with at least five key areas.

First and foremost, an active interbank market that enables banks to lend to one another – instead of going to the Central Bank for funds – needs to be urgently developed. This requires adjustments in current Central Bank regulations and the proactive introduction of new instruments such as REPO of government securities and swap, which are standard market practices. A vibrant interbank market with standard instruments will provide comfort to the banks in their ability to refinance their credit and facilitate the transmission of the Central Bank monetary policy. In short, it is the bedrock of any modern banking system.

Second, banks and the regulator must foster access to credit through a range of regulatory adjustments and change in lending practices. The current one-year maturity cap on loans should be removed, as well as the compulsory use of collateral. An increase in the lending spread (difference between deposit rate and lending rate currently set up by the Central Bank at 8% and 13% respectively) should be considered, to allow banks to extend credit to a larger part of the economic agents, who currently borrow at usurious rate in the informal sector. A gradual interest rate liberalization strategy should be defined and put in place in the mid- to long-term.

Third, trust in the banking system remains low, due to severe crises and bank runs in the past. Although trust cannot be decreed, there are many actions the regulator should take to improve the trust in the overall system. For instance, public disclosure obligations on banks should be strengthened with publication of audited financial statements made compulsory in the short-term and reporting standards to Central Bank reinforced. Penalties for noncompliance should be strictly enforced. In addition, longer-term measures should be carefully planned such as the creation of a proper Deposit Insurance mechanism or the creation of a credit bureau.

Fourth, the reform of the state owned banks must be initiated swiftly with multiyear goals. Today, Myanmar’s largest state owned banks operate as commercial banks without the required capabilities to do so and do not abide by the same set of rules and regulation. Their mandates should be clarified to focus them on their policy-lending functions, while their commercial banking activities be wound down, transferred or clearly segregated. The upgrade in their governance, organization and process will require significant efforts over time drawing on substantial technical assistance together with investments in their infrastructures.

Last but equally as important, shoring up the Central Bank’s independence, building up its capabilities and capacities will be critical to successfully steer reforms. It requires developing a long-term human resources strategy to attract talent, for which it will have to compete in the marketplace. It also requires an adequate funding strategy to support the upskilling and upgrading of its capabilities. Else, with limited financial autonomy, there will be limited policy autonomy.

Sector shakeup certain

In light of the massive changes to come, local players must ready themselves to seize the opportunities and overcome the challenges ahead. Competitive retail banking strategies should not just focus on increasing the numbers of customers, but also consider customer profitability and cost of acquisition. To do so, banks will need to review their current segmentations, products and services, not only relying on current revenues streams, but also considering future potential of the economic agents to be groomed. Getting the distribution mix right is critical to ensure profitability. Additionally, the role, format and integration of the branches with electronic channels will have to be reviewed, since bank branch concentrations are uneven. They reach Hong Kong’s concentration levels in West Yangon, while other parts of the country are white spots.

Besides retail banking focusing on network expansion and new customer acquisition, a corporate banking strategy may be even more important. Asset growth in the initial years will likely not be driven by retail but by corporate customers, which requires a different approach to be successful. Due to its development stage, banks will have to be prepared to offer everything from basic investment and financing products to solutions for liquidity management, foreign business banking, and in the medium- to long-term, corporate finance solutions. This brings about another hurdle, since sophisticated products require qualified specialists, a well-coordinated sales approach and support tools to enable relationship managers to successfully take on the task.

But not every bank will be privileged with opportunities to grow. Aside the top 3 or 4 banks, the question will be one of survival. The key reasons for this are the overall limited size of the market, increasing minimum capital requirements, and an anticipated increase in cost and required sophistication to comply with strengthening reporting and compliance standards. (The market size available to banks below the top 3 in Myanmar represents less than 1.5% of the Thailand banking market). They will need to consider a number of options, which include inevitably merger among peers or acquisition by bigger players in the market.

Ultimately, all banks will need to raise capital to match their growth opportunities. “Banking is a capital intensive business and institutions in Myanmar are short of it. Myanmar banks will have to increase their capital by over USD 22 billion by 2025 to realize their full growth potential,” Mr. Chassat said. “The ability to raise capital – especially in the short- and medium-term – will determine their fate. It will require profitable operations, appropriate governance and clearly articulated strategies to convince investors,” he added. Foreign equity investors are not yet an option due to regulation and practices, but banks should ready themselves to be an attractive option for when the change comes.

./wp-content/uploads/2018/10/Emirate-Online-TDY.png)

There are no comments at the moment, do you want to add one?

Write a comment