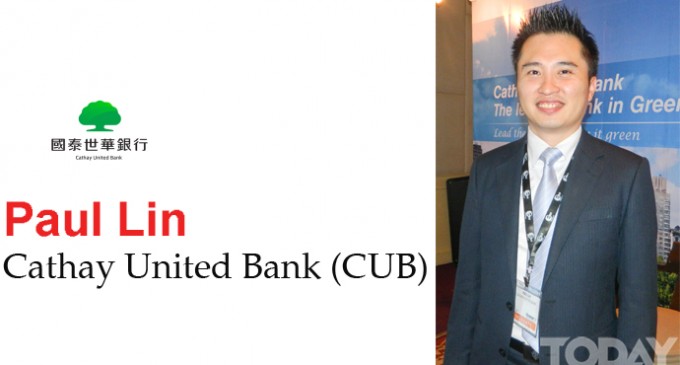

Paul Lin, Cathay United Bank (CUB)

Lately many foreign banks became interested in Myanmar, and would like to have a branch or representative office here. Cathay United Bank (CUB) which is into green financing is such a bank and TODAY magazine interviewed its Vice President Paul Lin on a short encounter.

What is CUB doing internationally?

We are engaged in credit financing for entrepreneurs in need of capital in regard of green energy projects. In the main we help raise credit for industry men producing electricity through renewable energy like wind, solar energy, etc. Moreover we advise the investors in their operational process.

CUB steps in Myanmar…

Our bank applied for a banking branch license in Myanmar once in 2014, and another time in February 2016. There is no response yet, but our trying will continue into years ahead. Banking work is not possible locally to us because ours is a representative office still. Currently we are helping out at Central bank and KBZ bank through training of their employees and sharing international experiences with them. At present, courses on industrial loans, then those on SME loans are planned. Moreover we advise would-be Taiwanese investors, collect economic facts & data, elaborate on Myanmar situation to prospective international investors, and explain how to cooperate with local banks. We also study markets, how to realize industrial loans through cooperation with local banks, and people’s needs as well as those of industries.

For having a representative office only in the country we cannot help finance local Green Technology companies yet. But we can do so to companies in other countries. Hence our cooperation with local banks. It would be a privilege if were could open a banking branch in Myanmar. Then we will need a local partner to watch over the feasibility of the industries which have obtained our loans. Wewould like to make use of our international experiences in Myanmar. Cathay United Bank is people centred so we feel the sooner its operation here the better its contribution to help advance the community environment. First and foremast we will help finance the industries which produce solar panels.

Collaboration of CUB and KBZ Bank

KBZ Bank has just penetrated international market. Cooperation between KBZ bank and CUB brings the former good prospects for overseas expansion, and the latter good prospects for local operation. A MOU signed between the two will provide for international banking services, technical aid and training, interbank business, and syndicated loan facilities. Currently local SMEs have received USD 80 million as inter banking loan thanks to cooperation between our bank and KBZ Bank.

Obstacles in applying for banking licence.

In applying for banking licence first time around successful banks were from China, Japan, Malaysia, Australia, New Zealand, Thailand and Singapore. As said before, we applied again in early 2016 but result is still unknown. If the Central Bank of Myanmar gave a third chance we would take it for sure.

Why do you think is no licence for you yet?

As far as I know, a good many international banks apply for a licence to invest each year but only one or two are usually successful. One possibility is, As local banks become successful gradually they fear for a great intrusion by foreign banks to control the market. The government also might be considering how to control the market.

./wp-content/uploads/2018/10/Emirate-Online-TDY.png)

There are no comments at the moment, do you want to add one?

Write a comment