UOB Survey Finds 7 In 10 Asian Businesses Planning To Expand Into Myanmar Within The Next 12 Months

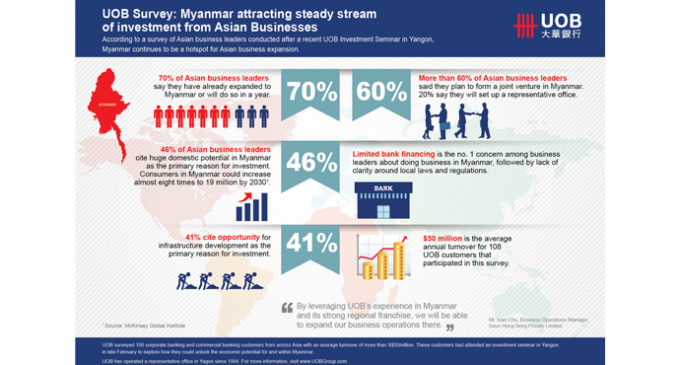

Yangon, 29 April 2014 – Seventy percent of Asian business leaders surveyed after they attended a recent United Overseas Bank event in Myanmar said they plan to expand into the country within the next 12 months. The results confirm Myanmar remains a key investment hotspot for companies looking for regional growth opportunities.

The survey, conducted among key decision makers of Asian companies with an annual turnover of $50 million or more, found that the two most compelling reasons behind their focus on Myanmar were the opportunity to provide goods and services to the country’s growing middle class (46 per cent) and the significant business opportunities present as a result of the country’s rapid transformation (41 per cent).

One such UOB customer seizing opportunities in Myanmar is hardware tools and safety equipment supplier Soon Hong Seng Private Limited. Mr. Ivan Chu, Business Operations Manager, Soon Hong Seng Private Limited said, “Myanmar’s fast-growing economy and its need for infrastructural development mean that there is a ready market for our hardware tools and safety products.

“This, combined with competitive labour costs and young and vibrant workforce, makes Myanmar an attractive expansion destination for our manufacturing business. However, as with any emerging economy going through a rapid transformation, Myanmar faces the challenges of changing local laws and investment regulations. It is here that UOB’s experience in Myanmar and its strong regional franchise help us to expand our business operations with a stronger level of confidence.”

Helping businesses navigate the challenges of expanding into Myanmar

Mr. Sam Cheong, Executive Director and Head of Group Foreign Direct Investment (FDI) Advisory Unit, UOB Group said, “The business opportunities in Myanmar are real and so too are the risks and challenges. As Myanmar’s pace of economic and social transformation has accelerated over the last two years, UOB too has looked to strengthen its support for businesses expanding into this market.”

As part of this, last year, UOB established an FDI Advisory Unit in Myanmar to help existing and potential clients to invest in the country. The Unit also helps customers navigate the challenges of expanding into Myanmar. Business leaders in the survey cited their top concerns when expanding into Myanmar as limited bank financing options (61 per cent) and the lack of clarity around local laws and regulations (53 per cent). Since the establishment of the unit, more than 50 companies have used its advisory services.

Customers looking to invest in Myanmar can tap into UOB’s deep expertise in the market. The Bank has a long-term commitment to share best practices in international trade, risk mitigation and working capital solutions with the business community, regulators and banks.

In addition to helping companies invest in Myanmar, UOB has also established eight other dedicated FDI Advisory Units across the region. These act as a springboard for customers to take advantage of UOB’s extensive banking network in Southeast Asia, as well as access its full suite of corporate banking, commercial banking and personal banking products.

Customers also benefit from UOB’s relationships with strategic partners in the legal profession, audit services, business consultancy and key government agencies across the region.

./wp-content/uploads/2018/10/Emirate-Online-TDY.png)

There are no comments at the moment, do you want to add one?

Write a comment